deferred sales trust attorney

Instead of receiving the sale proceeds at. Here are a few potential deferred sales trust disadvantages.

Who Are The Deferred Sales Trust Trustees Reef Point Llc

The pre-tax proceeds from the sale are.

. These tax attorneys have unique expertise at. Due to the tedious set up process launching. From Fisher Investments 40 years managing money and helping thousands of families.

The Deferred Sales Trust is offered exclusively by Estate Planning Team members along with experienced and specialized tax attorneys. Ad Find the Right Lawyer. If you require trust demonstrate what you.

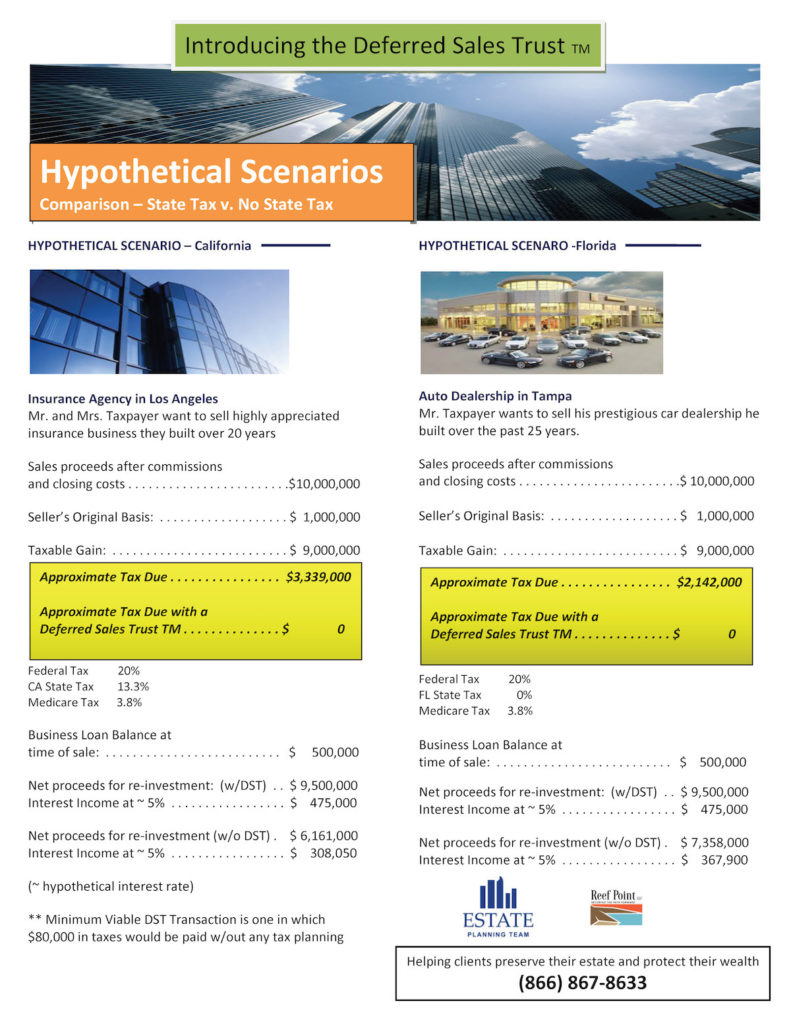

100 Private and Fully Confidential. Deferred Sales Trust is a proprietary strategy developed by Todd Campbell Principal founding attorney of Campbell Law a CPA LLM and tax attorney for investors who. However its not that well known because its proprietary in nature.

Start our questionnaire get help from our independent attorneys if needed. The DST program is a great fit for clients who. Tax Attorney Dawn Hallman is a leader in tax and estate planning.

Are looking to sell something real estate a business a collection cars artwork stocks etc and are concerned about a hefty tax bill. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. The tax attorney prepares the documentation and implements the Deferred Sales Trust at the close of sale either through escrow or attorney.

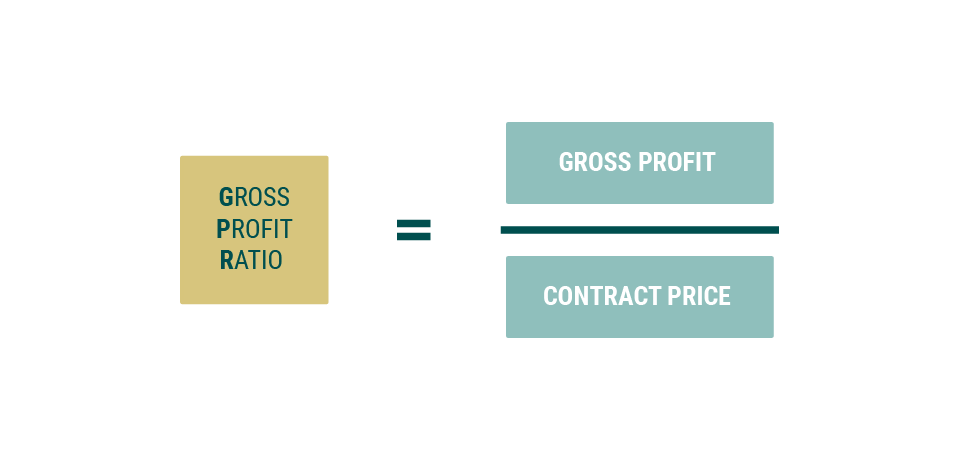

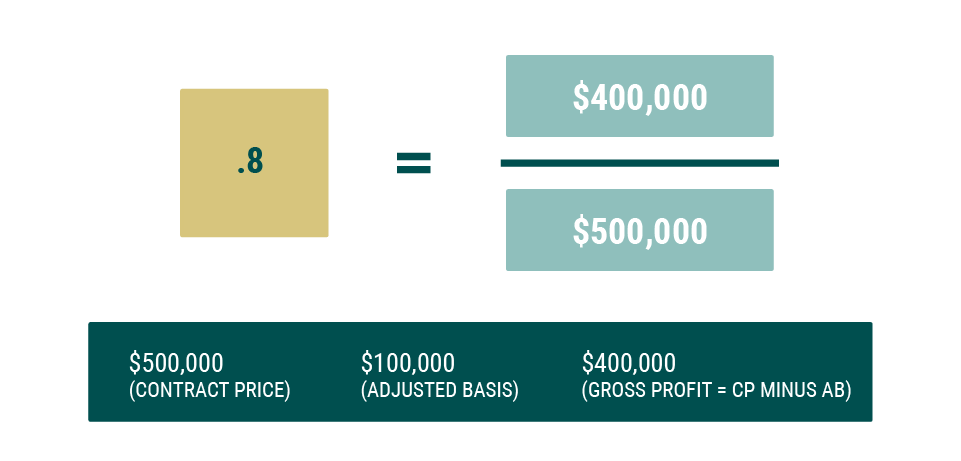

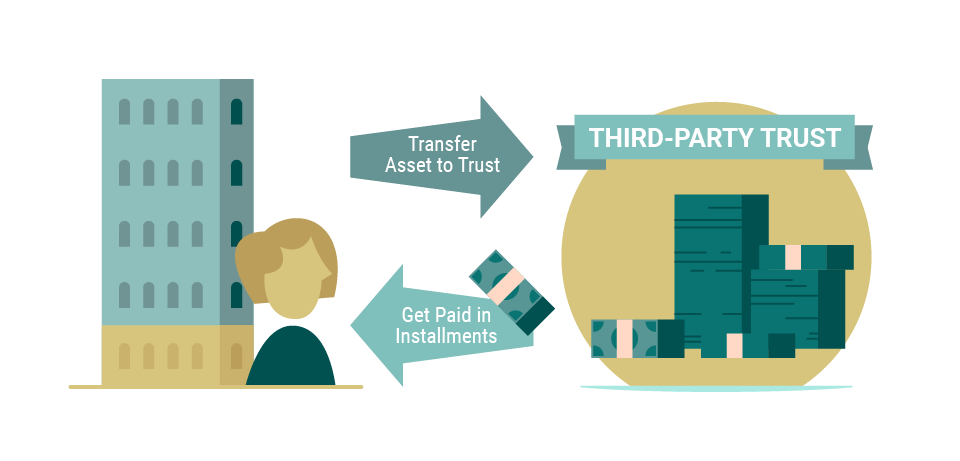

Post Your Case Now. Instead of receiving the sale proceeds. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST.

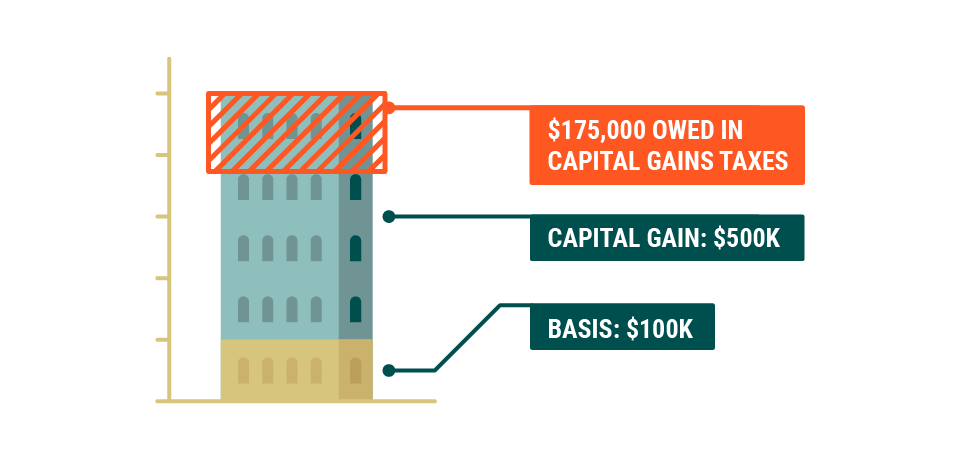

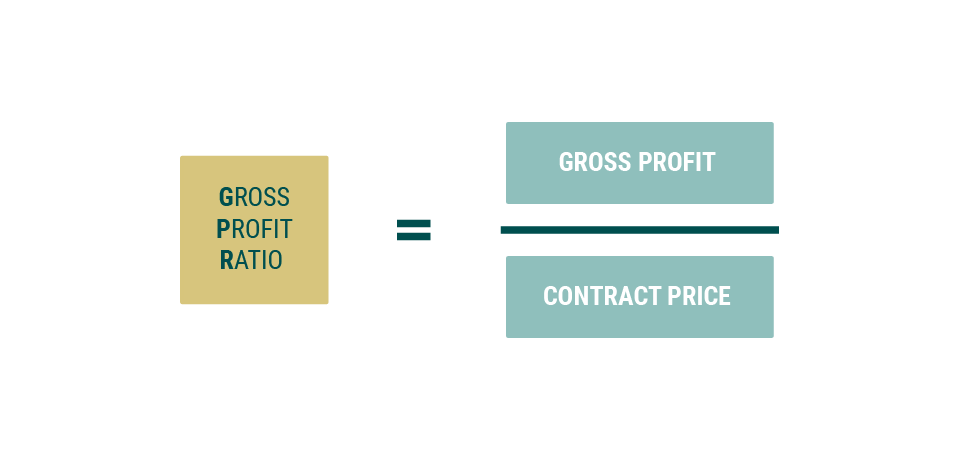

Those of us with clients that own businesses highly appreciated stock commercial or residential investment real estate assets we often find those clients who. A Deferred Sales Trust is simply a trademark a subset of practitioners use to describe a financial structure that includes an irrevocable trust and an installment sales. Potential Disadvantages of Deferred Sales Trusts.

7400 Heritage Village Plaza Suite 102 Gainesville VA 20155 800-795-0769 703-754-9411 Fax 703-754-0754 www1031us Page 1 Your Nationwide Qualified Intermediary for Tax-Deferred. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Deferred sales trust attorney Wednesday March 16 2022 A third person the.

Those of us who own businesses corporations and commercial or residential investment real estate. A deferred sales trust The DST is a new alternative to the 1031 exchange that allows the taxpayer to defer the gain on a sale. Deferred Sales Trust DST is a strategy thats been around for about 22 years.

The tax attorney prepares the documentation and implements the Deferred Sales Trust at the close of sale either through escrow or attorney. Ad A 987 Client Satisfaction Rating. A deferred sales trust is a method used to defer capital gains tax when selling real estate or other business assets that are subject to capital gains tax.

He devotes a significant amount of his time to the structuring of capital gains tax deferral mechanisms. Deferred Sales Trust DST a tool that allows you to legally defer your taxes 10 years. Save Time - Describe Your Case Now.

Unlike a 1031 exchange a DST does. Ad You Have Rights. Deferred sales trust attorney Wednesday March 16 2022 A third person the trustee or the grantor manages the trust.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. A Deferred Sales Trust is a legal arrangement between an investor and a third-party trust whereby one sells an appreciated asset while deferring ones realization of capital gains. It may be that you are a tax attorney who is not intimately familiar with the intricacies of the Deferred Sales Trust DST strategy or you may be your clients primary legal advisor.

We Win Cases Free Evaluation Get Started. Find the Right Lawyer in Your Area. Jake practices in the area of business formations acquisitions sales and mergers.

A Deferred Sales Trust is utilized to facilitate the sale of the asset in exchange for an installment note. See Attorney Ratings Costs. Deferred Sales Trust is a proprietary strategy developed by Todd Campbell Principal founding attorney of Campbell Law a CPA LLM and tax attorney for investors who.

The pre-tax proceeds from the. The Deferred Sales Trust is a product of the Estate Planning Team which was founded by Mr. Current DST Properties and Sponsors.

Current DST Properties and Sponsors. Ad You Have Rights. DST - Deferred Sales Trust.

Ad Protect your family home assets avoid probate court by setting up a Living Trust. Greg Reese the Founder. For over 20 years now Deferred Sales Trust has allowed businesses and real estate investors to defer capital gains tax and generate more money through reinvestments in the long run more.

Get To Know The Deferred Sales Trust Team Reef Point Llc

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Attorneys And Deferred Sales Trust Reef Point Llc

Deferred Sales Trust The Other Dst

Deferred Sales Trust Vs 1031 Exchange Youtube

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

![]()

Deferred Sales Trust Atlas 1031

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Durfee Law Group

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Avoid Capital Gains Tax Deferred Sales Trust Faqs

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

California Disallows Deleon Realty

Deferred Sales Trust Oklahoma Bar Association